Business Insurance in and around Edmond

One of Edmond’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

This Coverage Is Worth It.

It takes courage to start your own business, and it also takes courage to admit when you might need guidance. State Farm is here to help with your business insurance needs. With options like errors and omissions liability, extra liability coverage and a surety or fidelity bond, you can feel confident that your small business is properly protected.

One of Edmond’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Cover Your Business Assets

Whether you own a bakery, a pizza parlor or a donut shop, State Farm is here to help. Aside from exceptional service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

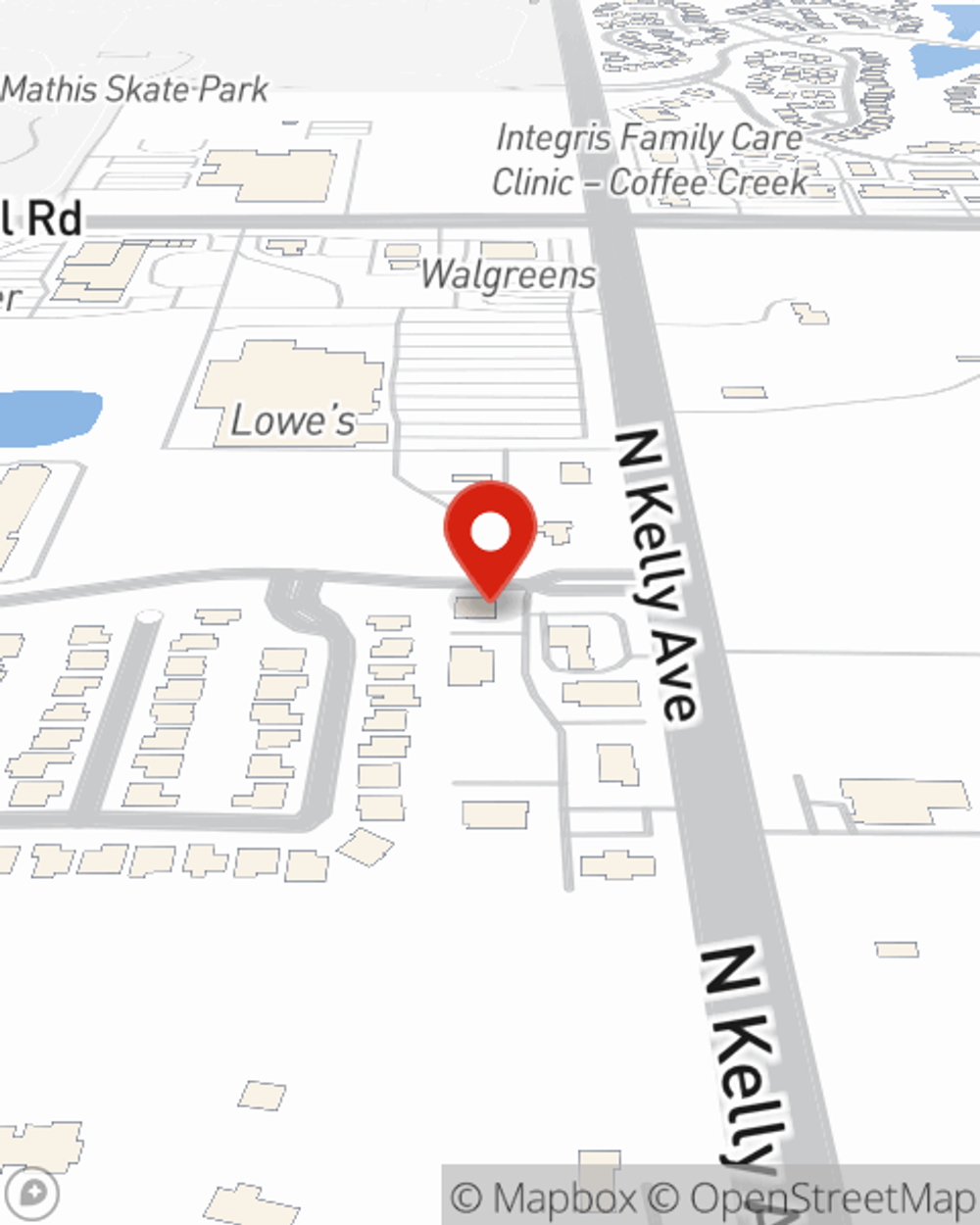

Agent Jennifer Lowder is here to talk through your business insurance options with you. Reach out Jennifer Lowder today!

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Jennifer Lowder

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.